When Rats Take Manhattan, What Happens to Broadway Ticket Prices?

I’ve always been fascinated by bizarre correlations that may or may not mean anything at all. This website was one shared to me by a college professor, illustrating the classic statistical warning that correlation does not imply causation (i.e: there is a strong correlation between “Associate degrees awarded in Criminal justice and corrections” and “Google searches for ‘Zombies’”). Yet, certain correlations can often reveal patterns that are insightful (or, at the least, entertaining).

On Broadway, we already know certain things track closely with a show’s Average Ticket Price (ATP): holidays, celebrity casting, glowing reviews. The ATP of a show doesn’t just reflect demand, though — it also is a critical input in estimating how quickly a show might recoup its investment. Producers often present investors with recoupment charts based on assumed ATP levels, projecting timelines for profitability. These assumptions though frequently fail to align with current Broadway economics, let alone broader macroeconomic conditions. As a result, investors often make decisions based on outdated/overly optimistic projections, which can lead to misinformed investments and, of course, unrealistic expectations.

With larger economic conditions uncertain, this got me thinking: could external economic indicators help us make smarter ATP assumptions? In other words, to what extent can we use macro trends like stock market performance or unemployment rates to better forecast Broadway’s financial outlook?

So, I ran a correlation analysis between historic Broadway ATPs and a mix of datasets (some serious, others just for fun), to see if there’s anything producers might use to forecast a show’s box office future.

Correlation Results

| Variable | Rationale for Including | Correlation (r) | Comments |

|---|---|---|---|

| S&P 500 Closing Price | Represents general consumer wealth and confidence. When stock market is booming, households may feel wealthier and splurge more on entertainment. | 0.86 (strong positive) | ATP tends to rise when the S&P 500 climbs, unsurprisingly. Better economic conditions = more discretionary spending. |

| Kerosene-type Jet Fuel Price | Jet fuel is a major component of airline costs. Higher fuel prices can mean increased travel (better for Broadway), or higher airfares/inflationary pressures (worse for Broadway). | 0.73 (strong positive) | Lots of potential reasons. Jet fuel could be a proxy for tourism or consumer spending. Another hypothesis has to do with seasonal trends -- jet fuel spikes in the summer and holiday seasons, which is often when Broadway ATP spikes as well. |

| US Unemployment Rate | Macroeconomic indicator that should influence discretionary spending. | -0.41 (moderate negative) | When unemployment is low, more people are willing to splurge on entertainment (driving up ATP). The correlation isn't as strong as expected, though, likely because Broadway's core audience skews wealthier and more tourism-driven (making it less reactive to general employment trends than other consumer industries). |

| Volcano Eruptions | Do more volcano eruptions mean a decrease in Broadway demand? | 0.04 (no correlation) | Just noise. Or maybe volcano eruptions often happening far from NYC don't have an effect on consumer behavior? Who's to say. |

| 311 Rodent Complaints (Rat Sightings in NYC) | Do more rats mean fewer tourists? Or does it mean more people need an excuse to get out of their apartment? | 0.49 (moderate/positive) | Maybe rat sightings are a proxy for urban energy; when the city's alive with people AND rodents, theater demand -- and ATP -- surges. |

Time-series comparison: ATP vs. S&P 500

Because the S&P 500 closing price had the strongest correlation (0.86), I plotted it against historic ATP on Broadway. The strong correlation between the two makes intuitive sense: both respond to shared economic forces like consumer confidence, inflation, and discretionary income. That said, ATP is noticeable less volatile than the S&P during economic downturns. During events like the dot-com crash or 2008 recession, ticket prices were not nearly as affected as the stock market. But during periods of strong economic growth, both metrics grew.

While ticket prices climb more steadily than stocks, they are still strongly correlated.

Time-series comparison: ATP vs. U.S. Unemployment Rate

The graph below compares Broadway’s ATP with the U.S. unemployment rate from 1980 to 2025. The relationship at first seems intuitive — when people are employed, they have more disposable income to spend on entertainment like Broadway shows. When unemployment rises, discretionary spending falls, so ticket prices may stagnate or decline.

This intuition is supported by the moderate negative correlation of -0.41, but I was a bit surprised that the correlation itself wasn’t that strong. Why the correlation isn’t stronger can be chalked up to a few potential hypotheses. Firstly, ATP doesn’t always respond immediately to change in unemployment — during the 2008 financial crisis, ATP dipped, but often with a delay, which’ll weaken the direct correlation. Furthermore, Broadway’s audiences include many international tourists, which means our metric of US-specific unemployment would not always track as neatly with demand for commercial theater. Another possible reason has to do with the complexity of ticket pricing — over time, more options for ticket prices have been introduced (VIP seating, exclusive experiences, etc), which can drive ATP upwards even while overall attendance and economic conditions are weak.

The moderate correlation of -0.42 between ATP and the U.S. Unemployment Rate reflects a complex dynamic between market forces, consumer behavior, and industry strategy.

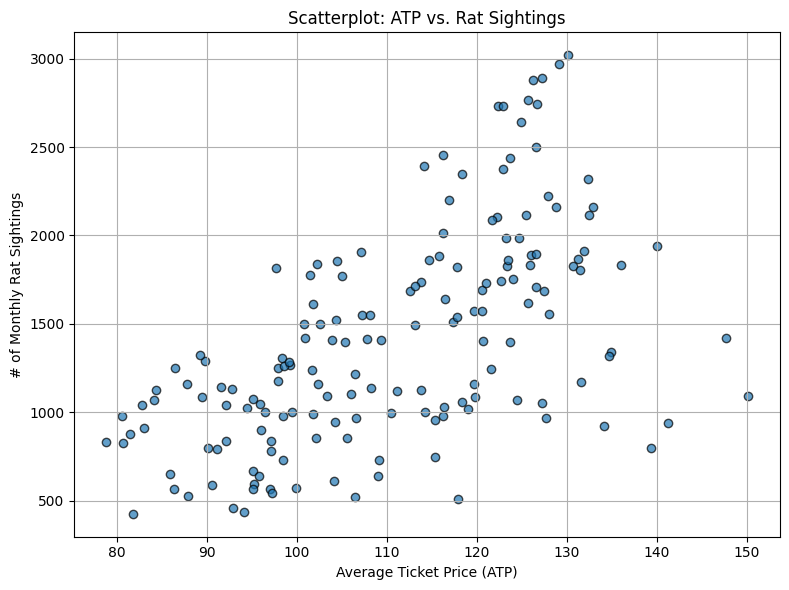

Scatterplot: ATP vs. 311 Rodent Sightings

When I ran the numbers, a surprising pattern emerged here: as NYC’s monthly rodent complaints rise, so do Broadway ticket prices, with a not-insignificant correlation of 0.49. Either rats are buying tickets or both metrics may be reactionary to the same underlying forces: more tourism, potentially meaning more trash.

Broadway ticket prices rise alongside NYC rodent complaints, with an oddly stronger-than-expected correlation of 0.49.

Takeaways

In the end, not every correlation tells a story, but the process of finding them can spark interesting questions as we start another Broadway season. Broadway’s economics don’t exist in a vacuum — from financial markets to urban patterns, external signals can offer producers and investors clues about pricing power, timing, and risk appetite. So while I’m not suggesting to hedge your investment strategies on rodent sightings, maybe it’s worth asking — are there numbers we should start looking at outside of our own industry? Can external indicators help us better understand the landscape in which certain shows are more likely to thrive? Perhaps aligning Broadway’s increasingly-lengthy development timelines with broader economic conditions might create a more adaptive, data-aware approach to producing. It’s not about rats or stock markets dictating art, but rather finding smarter ways to read the room before opening night.

Data Sources:

Broadway Grosses: The Broadway League. Weekly Gross Reports. Retrieved from https://www.broadwayleague.com

Show Metadata: Custom dataset compiled from IBDB.com and Playbill.com. Retrieved from https://www.ibdb.com and https://www.playbill.com

Consumer Price Index (CPI): U.S. Bureau of Labor Statistics. Consumer Price Index for All Urban Consumers (CPI-U). Retrieved from https://www.bls.gov

S&P 500 Index: Yahoo Finance. Monthly S&P 500 Closing Prices (1980–2025). Retrieved from https://finance.yahoo.com

Unemployment Rate: U.S. Bureau of Labor Statistics. Unemployment Rate (LNS14000000). Retrieved from https://data.bls.gov

Jet Fuel Prices: U.S. Energy Information Administration. Kerosene-Type Jet Fuel Prices: U.S. Gulf Coast [DJFUELUSGULF]. Retrieved from FRED, Federal Reserve Bank of St. Louis: https://fred.stlouisfed.org/series/DJFUELUSGULF (Accessed August 1, 2025)

Rat Sightings: NYC Open Data. Rodent Complaint Data via 311. Retrieved from https://www.data.cityofnewyork.us

Volcanic Eruptions Database: NOAA National Centers for Environmental Information. NCEI/WDS Global Significant Volcanic Eruptions Database. National Geophysical Data Center / World Data Service. https://doi.org/10.7289/V5JW8BSH (Accessed August 1, 2025)